Revving Up Private Equity Performance: A Commercial Excellence Approach

Written by Natasha Bunten

September 8, 2023

One of our clients is a global private equity firm, based in the midwest, with a focus on lower middle market deals. They were struggling with the drag of implementing repetitive processes at each portfolio company. The operations team was not maximizing their time effectively, and they realized adoption atrophy after they left the site. They lacked a go-to-market framework to efficiently disseminate sales & marketing best practices.

“Traditionally a lot of GTM processes are built off of a marketing vernacular or sales vernacular, but (Centrae is) kind of shifting it from those respective things to how things are actually bought.”

-CEO, security monitoring portfolio company

In an increasingly competitive environment, organic growth has become an essential element of deal success. At Centrae, we believe that the key to portfolio success lies in a relentless focus on developing commercial excellence capabilities, encompassing sales, marketing, and customer segmentation. It’s become increasingly evident that enhancing the commercial capabilities of portfolio companies significantly enhances the likelihood of organic growth, an indispensable element of deal success.

In the past two years, the private equity landscape has experienced record deal activity. General partners (GPs) are now under immense pressure to showcase performance. Historically, the two main strategies of cost-cutting or relying on economic growth to drive multiples are being challenged by macroeconomic uncertainty.

What is not typically factored into the exit valuation is the ability to generate profitable organic growth quickly. Achieving this entails a strategic focus on the top line and the development of commercial excellence capabilities that empower portfolio companies to sharpen their market approach. The task of boosting revenues, particularly in the face of economic headwinds, is undeniably more complex than optimizing a company’s cost structure. Nevertheless, accelerated top-line growth yields the most impact on exit multiples, enabling GPs to bid for companies with greater confidence, generate more value post-acquisition, and exit more smoothly.

Roadmap to Growth

When our client went from being a board member to CEO, he turned to the Centrae approach to growth for a third time. The process was guided by a GTM expert with the CEOs commitment to a strategic and meticulously executed process. By following the prescriptive commercial excellence program using the Centrae Platform, the CEO was able to realize 30% YOY revenue growth and became the highest performing portfolio company across the private equity firm – not just in the micro-cap fund, but all investments. The platform allowed the company to peel back the layers of their Ideal Client, Buyer Personas and define sales and marketing funnel stages with precision and clarity.

“I’m very proud of the fact that in 2022 we were the highest value creation organization across all of [the private equity] portfolio companies, not just micro-cap fund, but all 100+ companies.”

-CEO, security monitoring portfolio company

While revenue growth is influenced by a multitude of factors, from the leadership team talent, overall vision and frontline interactions, PE firms often allow complexity to stall out on transforming the business. Commercial excellence is deemed too “squishy” and time-consuming with cultural and mindset resistance. On the contrary, Centrae has found that a repeatable, predictable GTM process will enable a CEO to lead the company towards better clarity and focus talent on revenue-generating efforts. Putting energy behind the right value proposition and critical target accounts is one of the largest areas of opportunities for portfolio companies.

Very few firms invest in assessing their sales structure, territory design and pricing strategy – leaving a lot of revenue and untapped potential on the table.

Paving the Way for Growth

At Centrae, we recommend beginning the journey toward growth by categorizing target companies based on two key factors: the complexity of their sales process and whether they employ a direct or indirect model. Before a company can realize its goals, there needs to be alignment on where it is at. The next step is in assessing the core strengths and gaps to drive prioritization on the right opportunities.

Although that process can seem daunting at first, the Centrae platform has a built-in assessment that results in a visual chart of where the company’s biggest opportunities are based on proven best practices.

100-Day Plan

The most effective firms break their results down into manageable components of commercial excellence. Determining the priority issues allows the company to stack rank their initiatives by impact. Having a narrowed focus on the key deliverables allows the company to achieve early wins. For example, a company that determines there isn’t clarity or alignment around buyer personas may prioritize that to ensure their messaging is on target. However, creating 5-10 buyer personas can take weeks, if not months of research and meetings. Using the Centrae platform, most of our clients are able to build out polished buyer personas within a matter of days.

Centrae’s Four Main Frameworks

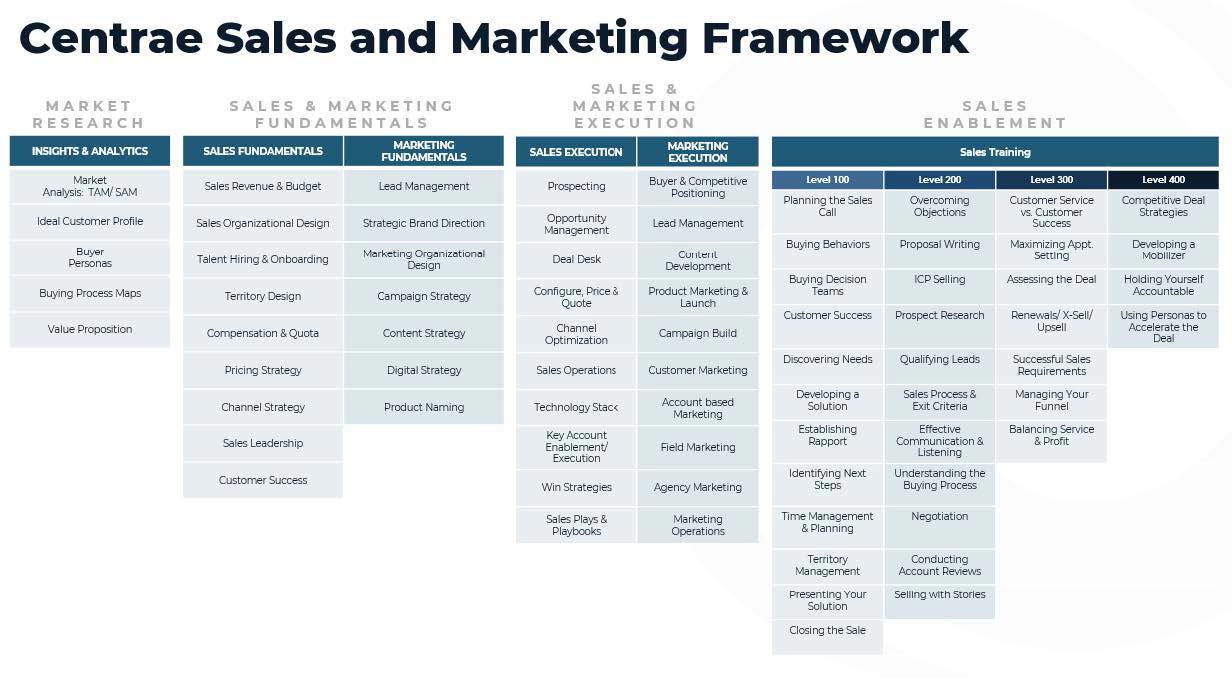

The platform supports the most critical components of commercial excellence between 41 workshops that fall under Four Main Frameworks, Market Research, Sales & Marketing Fundamentals, Sales & Marketing Execution, and Sales Enablement.

The Centrae GTM expert will guide the CEO and leadership team through the assessment, prioritization of initiatives and then each relevant workshop. The workshops are executed in rapid sprints, achieving quick wins by dividing efforts among team leaders. Those insights are then rolled up to the CEO and private equity firm, to demonstrate the rapid progress and adoption of best practices.

Critical leading and trailing indicators are easy to navigate on the dashboard, at a company or fund level, giving the portfolio operations team a clear direction of where to focus within each company to drive organic growth. The workshops build off each other, making the process of applying the strategy and tactics straightforward.

Follow-Up Growth

Having realized these benefits, the executive team wanted to uncover if there were even more opportunities to accelerate revenue. The new and improved customer focus left their previously solid strategies and playbooks in need of an upgrade.

With Centrae platform as their guide, they dug deeper to enhance areas that were initially considered to be well-developed during a second Centrae Assessment™.

As a result, they took the entire business up another leap in this second phase, going from $417K per mo in new client acquisition to $774k per mo without adding significant sales resources.

Delivering Results through Centrae’s Approach

Consistently delivering results like these can be challenging for PE firms that historically relied on efficiency measures and market beta for multiple expansion. However, in an environment where multiples have reached historic highs, the ability to accelerate revenue growth is likely to set top-tier performers apart. Developing the right capabilities begins with recognizing that top-line expansion is a realistic goal. By focusing on the essentials of commercial excellence, firms can establish straightforward and repeatable strategies for diagnosing issues and promptly addressing them. This approach opens up new opportunities among the vast number of companies that underperform commercially.

Centrae’s commitment to enable commercial excellence teams empowers private equity firms to unlock the full potential of their portfolio companies. Our approach on best practices is a proven, repeatable process to achieve value creation where organic growth is the key differentiator. Centrae clients utilize the tool as a means to scale their portfolio manager’s talent across several companies and yield higher multiples upon exit.

CENTRAE ASSESSMENT ™

The assessment application provides company and fund leaders the ability to measure the current state of their organizations, identify and visualize areas of opportunity, and track progress on improvements made as the team implements changes.

Related Posts

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.