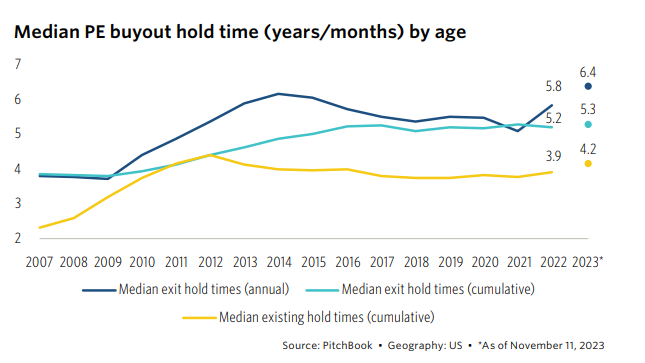

Holding periods of US PE-backed companies expected to hit new records as macroeconomic conditions remain weak

However, the building of PE company inventory and reduced returns back to LPs, is reducing the amount of capital available to raise new funds.

PE sponsors, whose expertise is in building businesses, are taking a closer look at what was historically left to functional leaders. Several lower middle market private equity firms are standing up their own in-house value creation teams or building out their existing one. These teams are tasked with supercharging topline revenue growth.

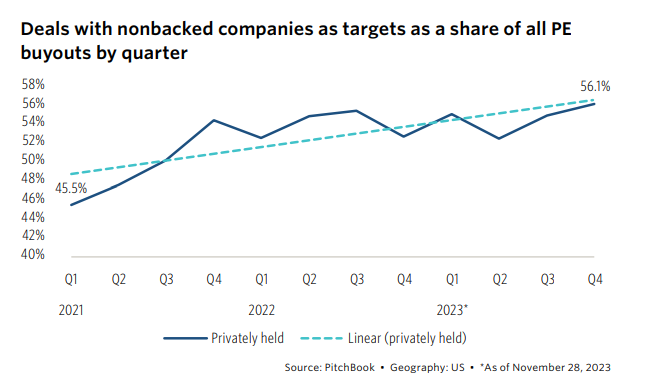

Founder-owned company deals continues to trend upward

I anticipate that PE will continue to harvest multiple-arbitrage by leaning into founder-led businesses with a buy-and-build strategy to compensate for strained exit valuations.

– Pitchbook’s “2024 US Private Equity Outlook”

In Conclusion

The two main trends of increasing hold times and increased focus on founder-led targets is spurring value creation roles in PE firms.

Here at Centrae, we focus very simply on articulating what the goal is, how it connects to the value creation plan, and how it gets measured. By adapting to market changes, aligning the strategy with the longer term investment horizon, the Centrae platform scales value creation execution across portfolio companies to prove out an attractive thesis, and ensure healthy returns despite a challenging exit environment.

Learn more about how Centrae’s laser focus on implementing go to market strategies in founder-led businesses can predictably scale your portfolio.

About Centrae, Inc.

The Centrae Platform pairs cutting-edge technology with expert services to empower revenue teams to consistently accelerate scalable, repeatable, and profitable revenue growth. Our unique combination of tools and expert professional services deploys proven best practices to optimize performance and operational excellence and maximize company value.

To learn more about Centrae’s unique process, please visit centrae.com