Uncertainty abounds in private equity. From Covid, to record deal flow, to sluggish exits, predictability is further and further out of reach. Now PE sponsors are scrambling to bring several investments to a successful exit and meet return expectations from their investors.

Uncertainty abounds in private equity. From Covid, to record deal flow, to sluggish exits, predictability is further and further out of reach. Now PE sponsors are scrambling to bring several investments to a successful exit and meet return expectations from their investors.

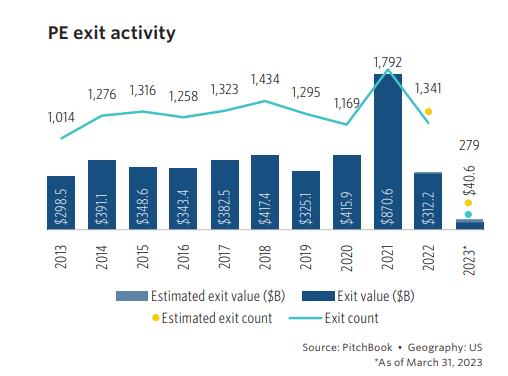

Private equity is reluctantly extending hold periods and stretching investment horizons, putting a further strain on ability to raise capital. According to Pitchbook, US PE exit value hit an air pocket in Q3 2023, falling by half from the prior quarter to its lowest quarterly level since the global financial crisis and now down 80%+ from the Q2 2021 peak.”

While continuation funds and secondaries may solve some of that, the buy and build strategy is a trend we are watching closely as PE sponsors race to exit from maturing investments.

“Add-on acquisitions are a common strategy to expand portfolio companies. The integration of these acquisitions plays a pivotal role in achieving value creation.”

-Rob Rossi, CEO of Risecor

How Successful Integrations and Value Creation Impact Investment Horizons

– Rob Rossi of Risecor

Rob Rossi of Risecor, “We have seen our PE customer deal flow drop by 30 – 40% in 2023. Also, Middle Market PE funds are acquiring small companies. The platform companies buying smaller companies means less value elevation for the platform, making organic growth a key lever.”

Value creation in private equity has been loosely defined, and somewhat idealistic. It primarily focuses on financial engineering and operational efficiency. According to data collected and analyzed by the Institute for Private Capital, PE has become less enamored with leverage over time as a focal point for value creation, dropping from 70% pre-2000 to 25% today. Energies in creating returns have primarily moved to operational efficiencies.

While financial and operational synergies may be important, business leaders continue to expect benefits from revenue initiatives. Many of these benefits come from improved brand leverage, pricing gains, cross-selling and new market entry. But these revenue drivers are often most at risk to fail due to a lack of a strong integration process.

– Craig Woll, CEO of Centrae

Summary

The dynamic nature of the private equity landscape is rife with uncertainty. Successful integrations timed with deploying GTM strategies are emerging as the linchpin for value creation.

Learn how strategic partnerships, like the one between Risecor and Centrae, are revolutionizing the buy and build approach, ensuring seamless integrations and optimizing returns.

About Centrae, Inc.

The Centrae Platform pairs cutting-edge technology with expert services to empower revenue teams to consistently accelerate scalable, repeatable, and profitable revenue growth. Our unique combination of tools and expert professional services deploys proven best practices to optimize performance and operational excellence and maximize company value.

To learn more about Centrae’s unique process, please visit centrae.com

About Risecor, Inc.

Risecor has +30 SMEs with +100 years experience and a proven track record handling 1) Add-On Integrations; 2) Platform Optimizations; 3) Pricing, Packaging, & Monetization Strategy; and 4) Pricing Optimizations in the private equity space.

To learn more about Risecor, please visit risecor.com